The Dream vs. The Reality

Imagine waking up to the sound of ocean waves in Bali, sipping on fresh coconut water while answering emails from your hammock. No office, no commutes, just freedom. Sounds like the dream, right?

But before you pack your bags, let’s talk about the fine print. Digital Nomad Visas and Digital Nomad Insurance are marketed as must-haves for location-independent professionals. But are they really? Are these just smart investments, or are they overpriced scams disguised as “essential” services?

Let’s break it down.

Digital Nomad Visas – A Golden Ticket or a Money Trap?

With remote work booming, many countries now offer Digital Nomad Visas—special permits allowing remote workers to legally live in a foreign country for extended periods. From Portugal to Thailand, these visas promise flexibility and freedom. But here’s what no one tells you:

The Smart Side of Digital Nomad Visas:

- Legal long-term stay – No more visa runs or border-hopping every 30-90 days.

- Tax benefits – Some visas exempt digital nomads from local taxes, saving you money.

- Work legally – No gray areas or under-the-table deals.

- Access to local services – Some visas grant benefits like bank accounts and healthcare access.

The Dark Side (aka The Potential Scam):

- High income requirements – Some countries require proof of earnings of $3,000+ per month.

- Hidden fees – Application costs, legal fees, and mandatory local insurance can add up.

- Complicated bureaucracy – Expect long wait times and strict documentation.

- Tax confusion – Some visas still require you to pay taxes in both your home country and the new country.

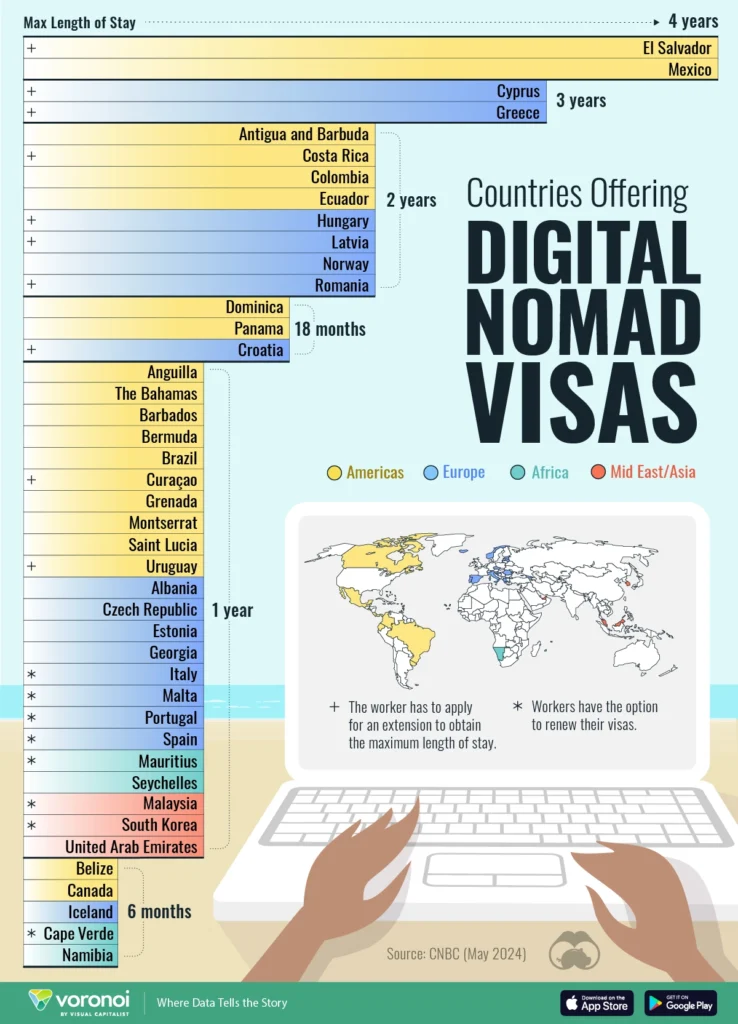

Where Can You Get a Digital Nomad Visa?

Here are some popular destinations offering digital nomad visas:

- Portugal – D7 Visa (1 year, renewable); income requirement: €760/month.

- Spain – Digital Nomad Visa (1 year, extendable up to 5 years); income requirement: €2,520/month.

- Thailand – Long-Term Resident Visa (up to 10 years); income requirement: $80,000/year.

- Bali (Indonesia) – Second Home Visa (5-10 years); income requirement: $140,000 in a local bank.

- Dubai (UAE) – Remote Work Visa (1 year); income requirement: $3,500/month.

- Costa Rica – Rentista Visa (2 years); income requirement: $2,500/month or $60,000 in a bank account.

How to Choose the Right Visa:

- Compare options – Use platforms like Nomadlist to check different country requirements.

- Check tax implications – Speak to a tax professional to avoid double taxation.

- Understand renewal policies – Some visas require renewal every year, while others offer long-term options.

It’s also worth noting the global shift in visa policies, such as the newly proposed Gold Card Visa in the U.S., which could impact digital nomads from countries like India and China. Learn more about the Golden card Visa implications to get a precise idea.

Digital Nomad Insurance – Essential or Overhyped?

You might think, “I’m young, healthy, and careful. Do I really need Digital Nomad Insurance?” Short answer: Yes. Long answer: It depends on what you get vs. what you pay.

Why Digital Nomad Insurance is Smart:

- Covers medical emergencies abroad, including hospital stays and surgeries.

- Protects against theft, trip cancellations, and lost baggage.

- Provides liability coverage in case of accidental damage or legal issues.

- Some plans include mental health support and wellness benefits.

When It Feels Like a Scam:

- Some policies exclude pre-existing conditions, adventure sports, or pandemics.

- High deductibles mean you still pay a lot out of pocket.

- Some companies make claims difficult to process or delay reimbursements.

Best Digital Nomad Insurance Options & Cost:

- SafetyWing – Starts at $45/month; covers medical emergencies, travel delays, and theft.

- World Nomads – $100-$200/month; extensive coverage including adventure sports.

- Cigna Global – Custom pricing; offers worldwide health coverage and direct billing.

- Allianz Travel – $50-$150/month; strong reputation and broad global coverage.

How to Pick the Right Insurance:

- Compare plans – Check what’s covered and what’s not.

- Read reviews – Look for companies with a strong claim approval track record.

- Consider add-ons – Some policies let you customize coverage for tech gear or extreme sports.

- Check your existing benefits – Some credit card or travel subscriptions may already offer partial coverage.

Are Travel Subscriptions & Digital Mailrooms Worth It?

Being a digital nomad isn’t just about visas and insurance—you also need practical solutions for travel and business operations.

Travel Subscriptions: Scam or Smart?

Some digital nomads swear by travel subscriptions like airline memberships, co-living discounts, and global WiFi services. But are they worth it?

Best Travel Subscriptions & Cost:

- Priority Pass – $99-$429/year; access to 1,300+ airport lounges.

- Nomad Internet – $149/month; global WiFi solutions for remote work.

- Selina CoLive – $450-$900/month; discounted stays in co-living spaces worldwide.

- LoungeBuddy – Pay-per-use lounge access; great for occasional travelers.

When Travel Subscriptions Make Sense:

- You fly frequently and use airline lounge access.

- You stay in co-living spaces and take advantage of discounts.

- You need global WiFi or VPN services to stay connected securely.

When They’re a Waste of Money:

- You don’t use the benefits enough to justify the cost.

- The perks are limited to specific airlines, hotels, or locations.

- There are hidden cancellation fees or long-term commitments.

Digital Mailrooms: Do You Really Need One?

A Digital Mailroom lets nomads receive and manage mail remotely. Services scan and upload your letters, allowing you to access important documents from anywhere.

Best Digital Mailroom Services & Cost:

- Earth Class Mail – $19-$79/month; full-service digital mail solutions.

- Anytime Mailbox – $10-$50/month; budget-friendly with flexible options.

- VirtualPostMail – $20-$90/month; great for business owners needing a permanent address.

Who Needs a Digital Mailroom?

- Business owners who require a legal address.

- Nomads who receive physical checks, tax documents, or important contracts.

- Anyone who needs a stable mailing address while frequently moving.

Who Doesn’t Need One?

- Those who use paperless billing and online banking.

- Nomads who don’t receive physical mail often.

The Verdict: Scam or Smart?

So, are Digital Nomad Visas, Insurance, and Travel Services smart investments or just clever marketing? The answer is—it depends on how and where you use them.

Red Flags to Watch For:

- Fake visa agents promising “guaranteed approval”—always apply through official government sites.

- Insurance plans that don’t clearly outline coverage.

- Subscription services with long-term commitments you can’t cancel easily.

- Hidden charges in digital mailroom services or travel subscriptions.

How to Play It Smart:

- Research visas on government websites and forums like Nomadlist before applying.

- Choose insurance with good reviews and clear coverage details.

- Avoid unnecessary subscriptions that don’t provide real value.

- Plan your finances to avoid unexpected tax issues and fees.

Final Thought: The Smart Nomad Wins

Being a digital nomad is about freedom—but freedom requires smart decisions. Don’t fall for marketing gimmicks, hidden fees, or unnecessary subscriptions. Instead, invest in the right tools, protect yourself with the right insurance, and choose visas that genuinely fit your lifestyle.